Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

After Rishi Sunak’s latest announcement of ‘Jobs, jobs, jobs’, businesses are really starting to step up a gear with returning to work after the lockdown. However, the ombudsman warns that employers could force pension opt-outs in a bid to save overheads.

But can they really do this? And what are your workplace pension rights?

All businesses in the UK must legally have a workplace pension scheme set up. This is usually a basic, low-cost, low-risk scheme (such as Nest), but it could be a more active investment scheme – it’s entirely your employer’s choice.

Employees can choose to opt in or out of the workplace scheme. If they opt out, they’ll get more money in their pay packet each month. However, they miss out on the compulsory employer contributions to their pension, which seriously adds up over time. Unless you really need the extra cash right now, opting in is the best thing you can do. It’s free money into your pension, after all!

Many employees now fall under auto-enrolment rules. As long as they earn above £10,000 a year, employees will be automatically enrolled into the workplace pension scheme. If you earn between £62,40 and £10,000 a year, you can apply to opt in (but you’re not automatically enrolled).

Opting in to the scheme means your employer has to contribute to your pension every month. You need to, as well, but it comes straight out of your salary before you receive it so you don’t need to do anything once you’re enrolled. You can choose to pay into a different pension scheme, but your employer doesn’t have to contribute – they only have to pay into the scheme they’ve chosen for the company. You’re allowed to have several pension pots, so if you move jobs make sure you consider whether you want to consolidate your pensions into your new scheme or keep them separate.

The Government also provides tax relief on your pension payments. This is in the form of 20% extra money into your pension pot for most people.

The question right now is how already-struggling businesses can manage their overheads. The pension scheme is a big monthly bill even for small companies. As many businesses seek to reduce their costs, there’s a worry that some employers might try to get their employees to opt out of the workplace pension scheme.

Forcing – or ‘encouraging’ – you to opt out of your workplace pension is illegal. Your employer simply isn’t allowed to do it! Telling you things like, “You’ll get more money to take home each month”, is seen as encouraging you to opt out. Unless you’ve specifically asked your employer to lay out the pros and cons of being in a workplace pension, or opting out, they can’t say things like this.

Your employer CAN reduce any voluntary additional contributions. So, they must still contribute a minimum of 3% each month. However, if they’ve been giving more – say 5% – they can reduce this down to the compulsory minimum.

You also need to be re-enrolled in your scheme every three years. There’s concern that some employers may knowingly – or unwittingly – let this slide in the confusion of flexible furlough and staff returning to work. However, they’re legally obligated to ensure you’re in the scheme, so if you haven’t been notified of re-enrolment within three months of your three-year enrolment anniversary date, raise it with your employer. Right now, it could be a genuine error, so approach this with a polite query at first. However, if they continue to delay or say they think you should opt out, that’s illegal.

It’s not just employers that force pension opt-outs causing concern, either. One further worry from the Pensions Regulator is that employers will take your contributions… and not hand them over to the pension scheme.

In the Financial Times, Antony Arter, pensions ombudsman, said: “I have already seen a small increase (in this). I’m convinced that will happen, most certainly.” Doing this means businesses will put the money in their own bank account to boost their coffers – and not support your pension. It’s also, in effect, stealing your money!

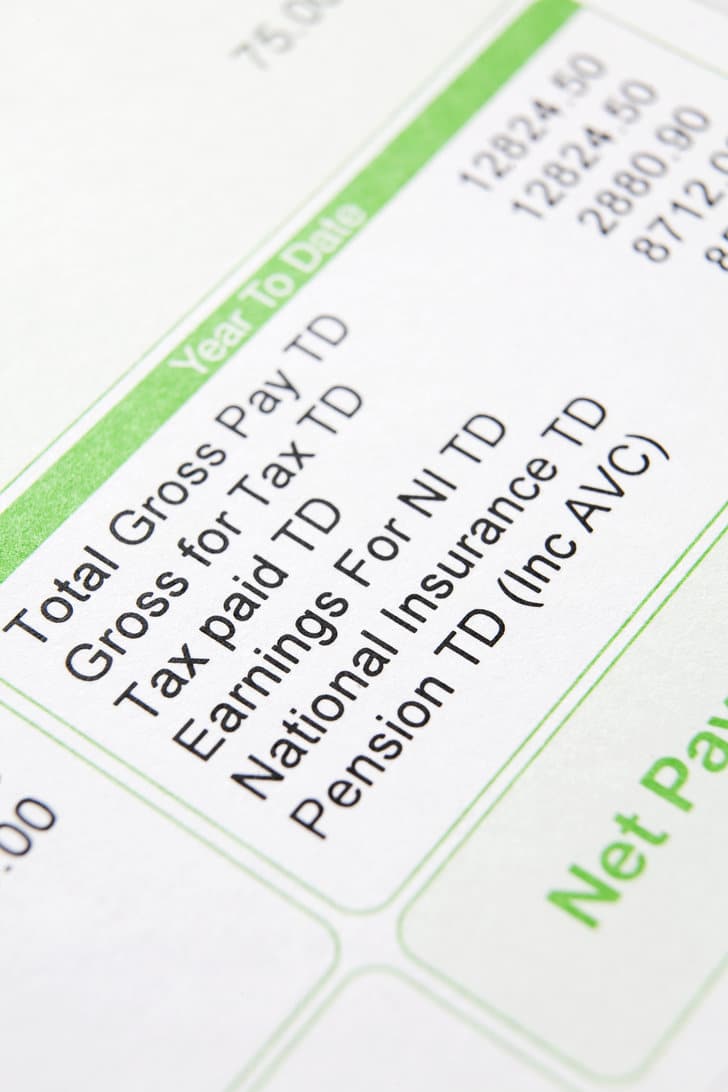

So, check your pension statement now – and then again in the next few months. Check that your pension contributions shown on your payslip each month are, in fact, going to your pension pot. There is a slight delay in this showing up – so check a few weeks after each payday. It takes time to process contributions so allow for that when you’re studying your statement.

Keeping your contributions and coaxing you to opt out of the workplace pension scheme are both incidences of flagrant disregard for the pensions rules. If you catch your employer doing either of these things, you must report them. You can’t get fired for reporting activity like this, either.

First, speak with your employer. They may have mis-phrased something when talking about pensions, or been vague in their understanding of the rules. This is particularly true if your immediate manager has said something about opting out, rather than your finance or HR department. Pensions are complicated, so those not handling them on a day-to-day basis may not be aware of the rules. They should be, of course, but we’re all human!

If you think any statement is a deliberate attempt to coax or force you to opt out of your pension, it’s time to act. The Pensions Regulator is the Government body handling all things pensions – and they’ll investigate any complaint.

Visit the Pensions Regulator website for details, call on 0345 600 7060, or email wb@[email protected]. You can also write to them at The Information Team, The Pensions Regulator, Napier House, Trafalgar Place, Brighton, BN1 4DW.

Reporting your employer may feel like snitching – but they’re doing you, and your fellow colleagues, an injustice. So, if things feel wrong or you can show your contributions aren’t reaching your pension – report it!

Pensions are complicated at the best of times, let alone in the middle of a lockdown and pandemic. Read these articles next to learn more about pensions and investing.

Some very good points covered here.

The world of pensions can be confusing. Appreciate the information.